Market Commentary

2022 Year in Review – The Perils of Traditional Diversification

December 17, 2022

Whether you are a regular or an occasional reader of investment updates, you have probably become accustomed to the use of the word ‘unprecedented’. Since the pandemic began nearly three years ago, it seems that almost everything we read about has a superlative attached to it …and often that descriptor implies that whatever is being discussed has ‘never happened before’ or ‘hasn’t happened in a long time’ or ‘has a significant impact’ on whatever the subject might be.

So, was 2022 unprecedented from a capital markets perspective? Well, by definition there are unprecedented elements to every calendar year. In 2022, we heard over and over about unprecedented stresses on the supply chain, Russia’s invasion of Ukraine, rapidly rising inflation followed by rapidly rising interest rates. But when all was said and done, how unique was 2022?

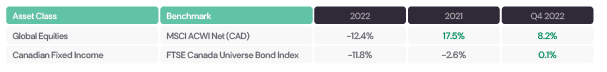

Broad equity markets (measured by the MSCI All Country World Index) lost 12.4% in 2022 - the lowest return since 2008, and fourth lowest since 2001

Fixed income markets (measured by the FTSE/TMX Canadian Universe Bond index) lost 11.8% in 2022. That’s the worst result in over 40 years.

Asset Allocation Didn’t Matter for Traditional Investors in 2022

Nobel Laureate Harry Markowitz introduced the ‘60/40’ portfolio to the world in 1952 as the foundation for what he called Modern Portfolio Theory (MPT). The fundamental premise of MPT was that a portfolio of 60% equities and 40% fixed income provided an optimal mix to balanced investors because of the low correlation between bond and equity returns.

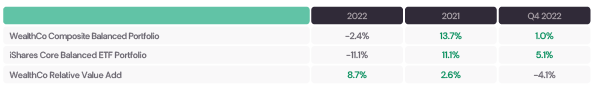

But Markowitz’s portfolio theory is no longer ‘modern’ … and its fundamental premise didn’t make a difference in 2022. Since both publicly traded equities and public fixed income lost about 12% in 2022, it didn’t matter much whether one’s allocation was 60/40, 80/20, 40/60 or some other mix of public bonds and equities. Most traditional balanced investors lost between 10%-14% in 2022 … and will require a 2023 return of 12%-16% or more simply to recover their losses.

Asset Allocation Did Matter for Alternative Investors in 2022

Forward thinking investors began moving away from a traditional public market mix in the 1990s followed by larger pension plans in the mid-2000s. WealthCo established its Alternative Income and Alternative Growth pools in 2014 and the benefits of diversification have been compelling, especially during 2022.

While Balanced WealthCo investors saw modest declines in the value of their investment portfolio in 2022 (generally between 2%-4% depending on their specific asset mix), those declines were much smaller than those suffered by investors who were in the traditional public market portfolios.

WealthCo’s Growth-oriented Funds

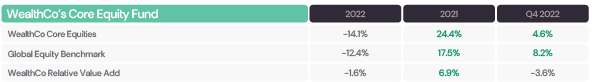

WealthCo’s Core Equity fund posted a return of 4.6% in Q4 2022, underperforming its benchmark by 3.6%. This period of underperformance is in contrast to the strong relative value add during 2021 (outperformance of 6.9%) and the first three quarters of 2022 (outperformance of 1.3%). The relatively weak Q4 2022 performance was primarily due to underperformance of the Canadian equity and US Small Cap portfolios along with underweights to Emerging Markets and non-North American stocks.

WealthCo’s Alternative Growth Fund

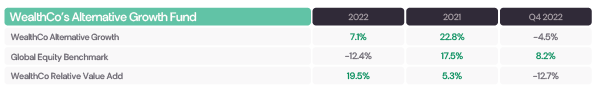

WealthCo’s Alternative Growth fund posted a return of -4.5% in Q4 2022, underperforming the Global Equity benchmark by 12.7%. Despite this challenging quarter, Alternative Growth outperformed its benchmark by 19.5% during 2022 following a solid 2021 (which outperformed by 5.3%). The relatively weak Q4 2022 performance was primarily due to write-downs on a few of our direct real estate office holdings along with updated valuations on some private equity partnerships which have a technology bias. The relatively strong 2022 performance was primarily due to stronger private equity performance earlier in the year along with gains across the US real estate portfolio, particularly with multi-family residential and other mixed-use commercial holdings.

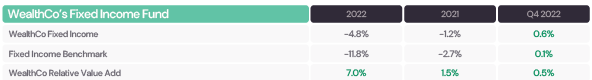

WealthCo’s Income-oriented Funds

WealthCo’s Fixed Income fund posted a return of 0.6% in Q4 2022, outperforming its benchmark by 0.5%. For the entirety of 2022, the fund posted a return of -4.8%, outperforming its benchmark by 7.0%. The relatively strong Q4 2022 performance was primarily due to the shorter duration of the fixed income portfolio which benefitted from the inverted nature of the Canadian yield-curve. The relatively strong 2022 performance was also due to the shorter duration of the fixed income portfolio along with its higher credit quality.

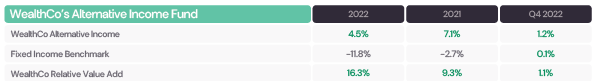

WealthCo’s Alternative Income Fund

WealthCo’s Alternative Income fund posted a return of 1.2% in Q4 2022, outperforming the fixed income benchmark by 1.1%. For the entirety of 2022, the fund posted a return of 4.5%, outperforming its benchmark by 16.3%. The relatively strong Q4 2022 performance was primarily due to rising yields across the corporate debt portfolio and limited exposure to longer duration securities. The relatively strong 2022 performance was also due to the significant exposure to floating rate securities across the portfolio.

Looking Ahead to 2023

While traditionally diversified portfolios didn’t provide diversification in 2022 and alternative investments significantly outperformed, by no means are we advocating for investors to abandon publicly traded securities and moving completely into alternatives. The road ahead will be uncertain as central banks continue their war on inflation. Ideally, we will collectively find a way to cool inflation, avoid a recession, and see interest rates start to decline in 2023.

May this be a ‘Goldilocks’ scenario? Perhaps, perhaps not. Because the timing of this balancing act remains uncertain, we continue to recommend that our investors diversify their portfolios with a similar allocation to both alternative and public market securities and an allocation to Growth vs. Income that suits their risk capacity and tolerance.

Wishing all our readers all the best in 2023!!!

Related Posts